The story surrounding the Zarai Taraqiati Bank Limited branches in Khan Bela and Muzaffargarh unfolds as a chilling testament to how widespread corruption and fraud can seep into even the most seemingly secure institutions. At the heart of this complex lies a coordinated and well-concealed scam that resulted in massive financial losses and deep-rooted mistrust in the system. What began as a routine inquiry into the conduct of some employees at the Khan Bela branch eventually uncovered a fraud of millions, the full extent of the deceit runs far deeper, stretching across multiple individuals, departments, and even reaching into high-ranking officers who, despite glaring red flags, managed to remain untouched.

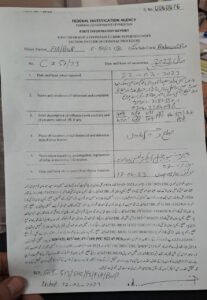

The story began when Arif Hussain, a resident of Rahim Yar Khan, lodged a complaint with the FIA Circle in Bahawalpur. His allegations were specific, naming key individuals within the ZTBL Khan Bela Branch, including managers, cashiers, operation managers, and mobile credit officers. These individuals, using their positions and access to sensitive financial operations, allegedly conspired to misappropriate a vast amount of money, forging documents, tampering with records, and manipulating the system to facilitate the fraud. The list of accused individuals paints a disturbing picture of coordinated action within the bank’s internal ranks—people who were trusted with public funds, now accused of betrayal.

Despite the extensive documentation and findings from initial investigations, the response from the higher authorities appeared to lack urgency and seriousness. Orders were finally issued to register a formal case, yet the delays and hesitations in arresting those responsible hint at possible protection or influence from more powerful quarters. It wasn’t long before the role of the Regional General Manager (RGM), Muhammad Zahid, surfaced repeatedly in the narrative. His visits to the branches, interactions with accused managers, and refusal to take action despite being informed of irregularities signaled a deeper involvement than he might have been willing to admit.

Allegations further intensified with claims that RGM Zahid had accepted monetary offers from those under investigation, and in turn, offered silence and inaction. Even after damning evidence emerged, he remained in his position, traveling frequently, allegedly receiving travel allowances, and continuing his professional routine unbothered. Meanwhile, those with no political connections, power, or influence—branch-level employees—were left to bear the brunt of the legal consequences. Their arrests were swift and highly publicized, giving the illusion of justice being served, while those in higher positions remained untouched.

The pattern repeated itself in the Muzaffargarh branch, where another large-scale fraud of Rs. 60 million came to light. Once again, the names of those responsible followed the same script: low-level staff were targeted, investigated, and arrested. However, those who orchestrated or facilitated these fraudulent schemes from behind the scenes stayed immune. According to insiders of The Inquirer, the RGM’s role in the Muzaffargarh case mirrored that of Khan Bela—frequent visits, complete knowledge of the financial anomalies, and yet, no actionable steps to prevent or report the fraud.

The issue takes an even darker turn when observers begin to connect the dots between these crimes and the lifestyles of those believed to be involved. Luxurious properties, extravagant expenditures, and lavish farmhouses—allegedly owned by or linked to Muhammad Zahid—come under scrutiny. Questions about how such wealth was accumulated remain unanswered. Critics point fingers at the institution’s top leadership for enabling or ignoring these behaviors, accusing them of complicity either through direct involvement or sheer negligence.

Those who raised their voices against the corruption claim they were sidelined or made scapegoats. Accusations suggest that the whistleblowers were manipulated, threatened, or left out to dry. Their warnings were either ignored or downplayed, and in many cases, they too were implicated in the frauds they tried to expose. What remains evident is a chilling culture of favoritism and protectionism within the bank’s management, where accountability is applied selectively, and justice appears as a tool for silencing dissent rather than upholding integrity.

The public, especially depositors and farmers who rely on The Zarai Taraqiati Bank Limited, remain the ultimate victims of these deceptions. Funds meant for agricultural development and rural financial support were misused by those who had pledged to serve these very communities. The trust they once had in financial institutions continues to erode as more such cases come to light, highlighting the need for greater transparency, stricter oversight, and independent investigative bodies.

Despite all the revelations, the core concern remains—recovery. While some arrests have been made, and FIRs filed, little has been done to recover the stolen funds. No significant progress has been made toward reclaiming the defrauded money. The viewers and public continue to ask the same question: where is the money, and why haven’t the powerful names been held accountable?

Until there is clear, visible action taken against not just the foot soldiers but also the masterminds of these scams, the perception of immunity for the influential will persist. These events demand an institutional overhaul, starting with a comprehensive audit of all regional branches, an independent body to oversee investigations, and transparent communication with the public about progress and findings. Only through such reforms can trust be rebuilt and justice ensured.

The story of the frauds at Khan Bela and Muzaffargarh is not just about embezzlement. It is a cautionary tale of systemic rot, unchecked power, and the failure of internal accountability mechanisms. If left unresolved, it will serve as a blueprint for future wrongdoers, teaching them that with enough connections, money, and silence, even the biggest crimes can be swept under the rug.

Also Read This: